LMM BLOG

COMPOUND INTEREST EFFECT

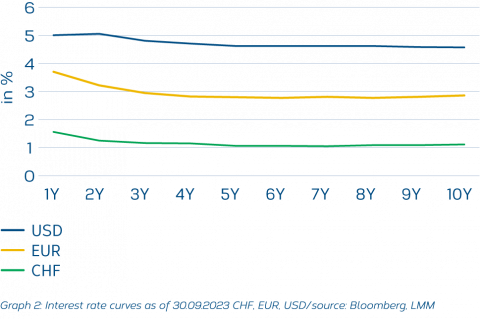

The most important central banks have turned the interest rate screw vigorously in recent months and the expected interest rate hikes have now become reality. The market assumes that interest rates have already peaked, or at least have almost peaked. Moreover, looking at the yield curves, the expectation is gaining ground that interest rates will probably remain at elevated levels for some time to come. This means that investors can expect substantial interest income again. And thus the compound interest effect, which had almost been forgotten, is gaining in importance again. Or as Albert Einstein put it: “The compound interest effect is the eighth wonder of the world. Those who understand it earn money and those who don’t, pay for it.”

In the past period of low interest rates, investors have come to terms with the fact that risk-free investments do not yield a return. In the coming years, things will look very different, as the following example illustrates.

Example: We assume an invested capital of 100 and assume a constant interest rate of 5% over the next few years (note: the interest rate assumption roughly coincides with the USD interest rate curve as of 30.09.2023, see graph 2).

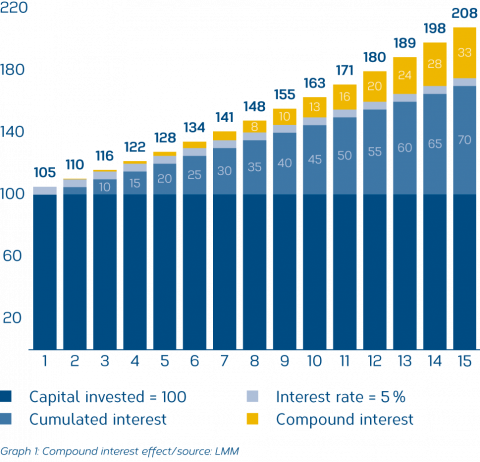

The performance of our investment can be divided into three components.

- The first component is the invested capital, which remains constant at 100 and is paid back at the end of the term.

- The second component is the annual interest of 5 %, which adds up linearly over the entire investment period and will amount to 75 after 15 years.

- The third component, compound interest, assumes that the interest received can be continuously reinvested at the interest rate of 5 %. Compound interest (marked in yellow) then develops exponentially and contributes more and more to the overall performance over time. In the example, it grows from practically 0 in the first years to a total of 33 after 15 years.

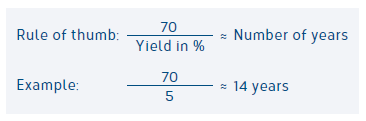

If we look at the total return over time, we see a doubling of the invested capital after about 14 years. As a rule of thumb, the rule of 70 can also be used to calculate the time needed to double the invested capital.

In summary, it can be said that in the current interest rate environment and with the help of the compound interest effect, interest income cannot be neglected.

However, in order to achieve a real increase in value, the admixture of other asset classes (especially shares) will continue to be necessary.

LMM COMPASS

With our newsletter we provide information about the current situation on the financial markets, current investment topics and LMM.