LMM BLOG

“STIFTUNGSMONITOR” SURVEY

The legal institution of the private foundation was created in Austria in 1993. Since then, more than 4,000 foundations have been established. In 2024, nearly 3,000 of these foundations will still be active. Since 2020, we have been supporting the independent foundation platform stiftung-nextgen

(www.stiftung-nextgen.at) with our expertise in designing and conducting the annual “Stiftungsmonitor” survey. The survey covers topics such as organization, generational change, and asset management.

Below we summarize some of the results of the most recent survey, conducted at the end of 2024.

Economic and Political Environment

The legal and political environment is a key factor in the choice of location. At around two-thirds, corporate investments account for the majority of assets in Austrian foundations. Only 43 % of all Austrian founders would establish a foundation again today. The attractiveness of Austrian private foundations has continued to decline in recent years. Interventions in the taxation of foundations, as well as a changed legal and political environment, have led some 64% of Eastern European founders to consider moving their foundation to Liechtenstein.

Organization

The law defines the organs of a foundation, which are either mandatory or optional. In addition, it is important to set up a suitable organization to ensure efficient control and management of the assets. Various stakeholders (e.g., beneficiaries) can be involved through the appointment of advisory boards. An independent reporting and controlling body ensures the separation of powers between investment and control within a foundation.

Approximately two-thirds of all Austrian foundations have an advisory board. In less than half of the cases, the next generation is represented. Just over half of all foundations have investment guidelines. Very few foundations have independent investment controlling and comprehensive asset reporting.

Cryptoassets in asset management

In Europe, there are now also cost-effective ways to invest in cryptoassets. ETPs (exchange-traded products) make it possible to replicate the performance of the underlying cryptoassets almost 1:1. Some products even allow the physical payout of bitcoins. Around 9 % of foundations stated that

cryptoassets are part of their investment strategy. However, only 17 % of foundation managers stated that they wanted to make decisions in this area themselves. Cryptoassets are predominantly used as part of the management by banks and asset managers.

Strategic asset allocation and investment results

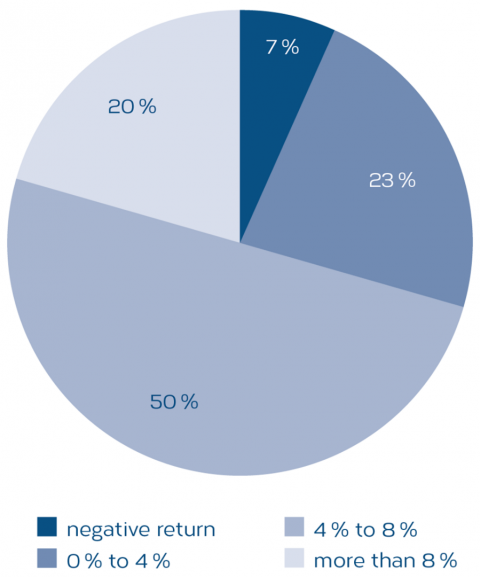

The majority of foundations (around 43 %) pursue a balanced investment strategy (50 % equities). 27 % state that they are invested conservatively (30 % equities) and 30 % pursue a dynamic strategy (70 % equities). In 2024, all standard strategies (portfolios diversified by asset class, region and sector) with EUR as the reference currency achieved positive results. The results were between 5 % (conservative) and 13 % (dynamic). The distribution of the investment results of the foundations' securities assets is as follows:

The results suggest that at least a quarter of the respondents underperformed a comparable risk benchmark. In these cases, a more in-depth analysis of the investment performance is recommended to determine the reasons for the deviation.

Conclusion

The results of the foundation survey show that new topics such as cryptoassets are becoming more important as the generations change. Involving the next generation of beneficiaries in the process of managing the foundation's assets is an organizational challenge for some foundations. Involving an independent investment controller can help avoid conflicts.

We recommend that asset owners who are interested in the advantages of a foundation structure compare different foundation models under civil and tax law.

For further insight into the survey results, or if you have any questions about our services, please feel free to contact us personally. Get in touch with us.

LMM COMPASS

With our newsletter we provide information about the current situation on the financial markets, current investment topics and LMM.