LMM BLOG

DOES MIFID II CREATE COST TRANSPARENCY?

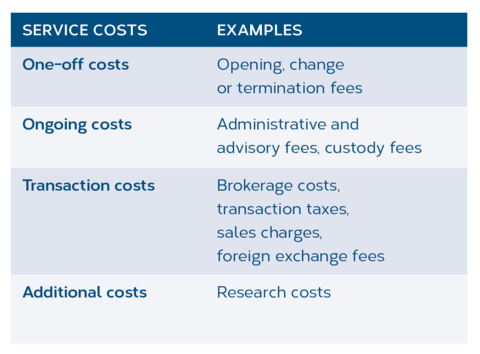

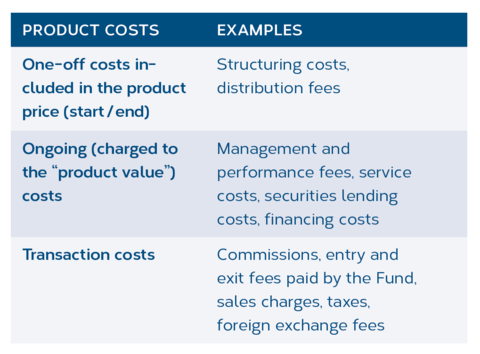

The requirements of the second European Financial Market Directive (“MiFID II” for short) oblige financial service providers to inform their customers about all costs and additional costs in connection with investment services and the relevant financial instrument. Fees and costs were previously shown spread over several documents. Customer-related costs were found in advisory or management contracts, ancillary agreements to contracts or fee schedules. Product related costs could be taken from the Key-Investor-Information Document (KIID or KID) or Factsheets. The aim of the legislator was to compile this information in a clear way for the customer. In future, financial service providers will have to inform their customers about the costs and additional costs of the product or service both before (ex-ante) and after (ex-post) service provision. Upon request, the financial services provider must also provide the customer with a detailed itemized list of costs. It contains at least a breakdown into one-off and ongoing costs and also informs about costs related to transactions and ancillary services. In addition, contributions from third parties have to be disclosed.

However, many requirements are not defined precisely in the directive. This opens up room for interpretation and leads to the fact that the cost statement can look different from one institute to another regarding content. In the case of investment funds, the actual costs often only come with an annual statement, i. e. are available months later. Caution is also required for products that have no explicit costs, but where the costs are indirectly offset by the interest. An isolated assessment of individual cost items is not recommended. An overall assessment of costs, returns and risk expectations is necessary in order not to limit long-term investment opportunities due to short-term effects. With our daily Investment Controlling activities, we have already made the costs transparent and ensured that these are settled in accordance with market and contractual requirements. We also ensure that the comparisons are made according to a consistent approach to give you an optimal basis for decisionmaking.

LMM COMPASS

With our newsletter we provide information about the current situation on the financial markets, current investment topics and LMM.