LMM BLOG

Markets and strategies 2025 Q3

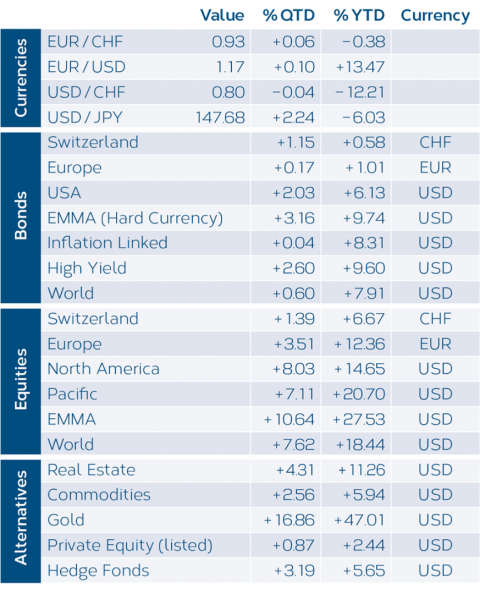

The third quarter was characterized by the announcement of new U.S. tariffs, high expectations surrounding artificial intelligence, and a sharp rise in the gold price. Following interest rate cuts by the ECB and the SNB, the U.S. Federal Reserve also lowered rates for the first time this year in response to signs of weakness in the labor market.

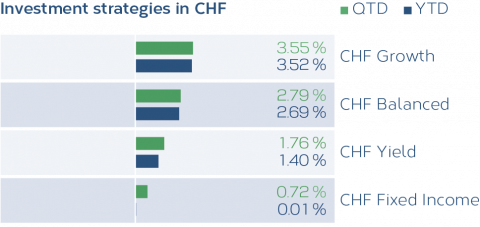

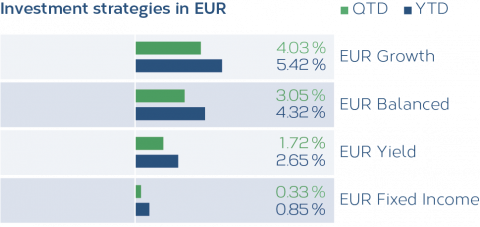

All investment strategies delivered positive performance in the third quarter, supported by falling interest rates (rising bond prices) and strengthening USD equity markets. Notably, U.S. equities and emerging markets increased their year-to-date performance in USD to around 15 % and 28 %, respectively. The pattern remains unchanged: the higher the equity allocation, the stronger the annual performance.

Calculation LMM; reference date 01. 01.– 30. 09. 2025

Note: the figures are before costs

Calculation LMM; Period 01. 01.– 30. 09. 2025

LMM COMPASS

With our newsletter we provide information about the current situation on the financial markets, current investment topics and LMM.