LMM BLOG

Markets and Strategies 2025 Q2

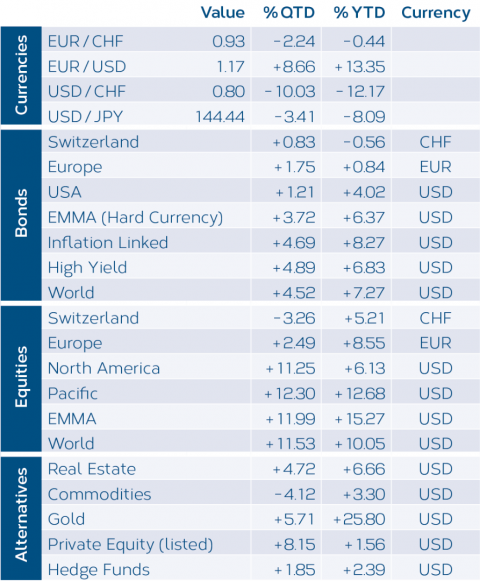

The second quarter of 2025 was influenced by several key factors: In addition to the market distortions caused by the US tariff announcements, the interest rate cuts by the European Central Bank (ECB) and the SNB and the recovery on the equity markets should also be mentioned. The US dollar continued to lose value, while European equities maintained their outperformance relative to US stocks. Gold remained in demand as a “stabilizer”.

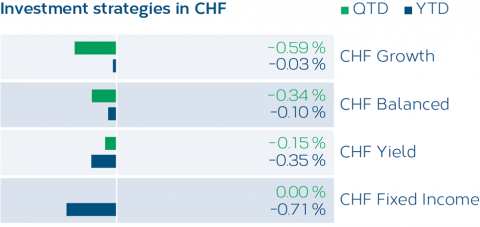

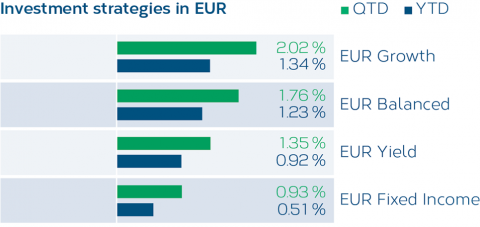

Overall, CHF investment strategies posted slightly negative returns, while EUR strategies ended in positive territory. The differences can be attributed not only to the level of equity and foreign currency exposure but also to how equity investments were implemented. For instance, a global approach with an overweight in US equities had a negative effect compared to a strategy with a stronger “home bias”.

Calculation LMM; Period 01.01.2025–06.30.2025

Note: the figures are before costs

Calculation LMM; Period 01.01.2025–06.30.2025

LMM COMPASS

With our newsletter we provide information about the current situation on the financial markets, current investment topics and LMM.