LMM BLOG

MARKETS AND STRATEGIES 2024 Q3

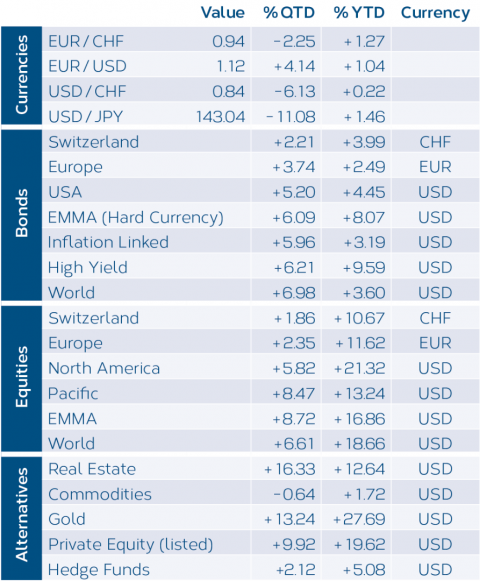

Due to the weakness of the US dollar, falling US real interest rates and geopolitical uncertainties, the price of gold has reached an all-time high. Global stock indices have fully recovered from the interim losses in August in a classic V-shaped recovery. The S&P 500, for example, is back near its peak.

The European Central Bank (ECB) has, as expected, cut key interest rates for the second time by 0.25%, but left open whether a further rate cut will follow in October. Growth forecasts for the eurozone have been revised slightly downwards. The US Federal Reserve (Fed) cut interest rates by 50 basis points to a range of 4.75% to 5%.

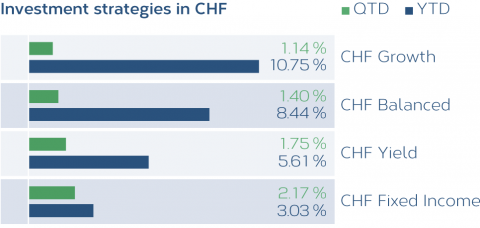

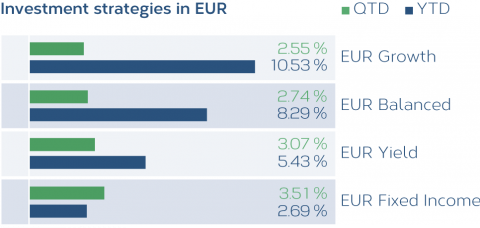

Both in the third quarter of 2024 and in the current year, all CHF and EUR investment strategies show a positive result. For the current year, the higher the equity ratio, the better the performance. For the past quarter, the opposite applies: the lower the equity ratio, the better the result. Since the beginning of 2024, the CHF investment strategies have produced results between +3.03% and +10.75%. The EUR investment strategies are in the range of 2.69% to +10.53%.

Calculation LMM; Period 01.01.2024 – 30.09.2024

Note: the figures are before costs

Calculation LMM; Period 01.01.2024 – 30.09.2024

LMM COMPASS

With our newsletter we provide information about the current situation on the financial markets, current investment topics and LMM.