LMM BLOG

MARKETS AND STRATEGIES 2021 Q2

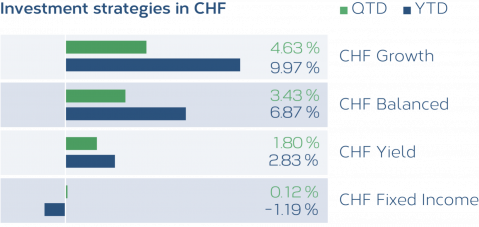

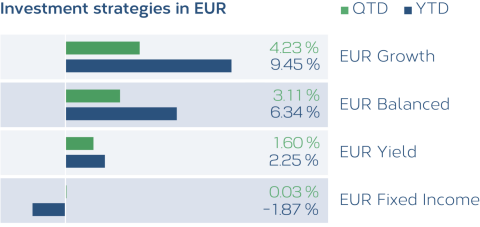

The economic data confirm that the global economic upswing is continuing. Investors continue to assume that monetary policy will remain expansionary and that the current "overshooting" inflation figures are only of a temporary nature. Accordingly, analysts’ earnings expectations have been revised significantly upward due to the stronger than expected recovery. The risk of renewed corona outbreaks is considered to be lower in view of the “vaccination rates” already achieved, especially in Western countries. In the 2nd quarter, investment strategies made further gains thanks to good equity returns. Thus, once again, the level of equity exposure was responsible for the quarterly returns. Additional performance contributions were achieved by adding exchange-traded real estate and commodity investments, among others. In bonds, the riskier segments, such as high yield and emerging markets, as well as inflation-linked bonds, benefited.

Calculation LMM; reference date 30.06.2021

Note: the figures are before costs (exclusive of custody- and management fees)

Calculation LMM; Period 01.01.– 30.06.2021

LMM COMPASS

With our newsletter we provide information about the current situation on the financial markets, current investment topics and LMM.