LMM BLOG

MARKETS AND STRATEGIES 2021 Q1

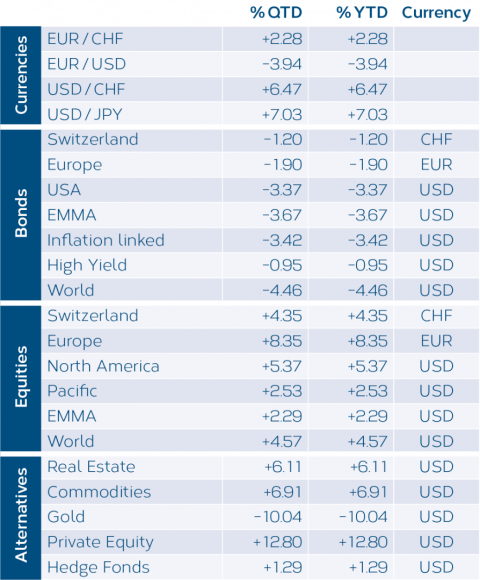

The unexpected rapid rise in yields on the bond markets – the globally observed interest rate for 10-year US government bonds rose from 0.9% to 1.6% in the meantime – led to a change of favourites on the stock markets. Value stocks were favoured over growth and technology stocks. The passing of the USD 1.9 trillion stimulus package in the USA gave a strong boost to individual equity sectors, and sectors such as energy and finance posted strong gains. Rising inflation expectations, supportive stimulus packages and confidence in accelerated economic growth after the end of the pandemic will continue to influence the markets in the coming weeks.

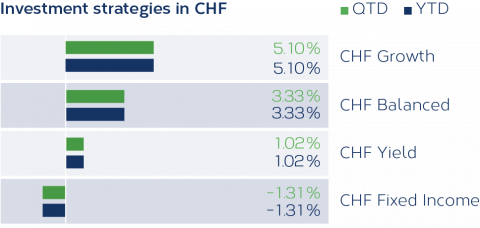

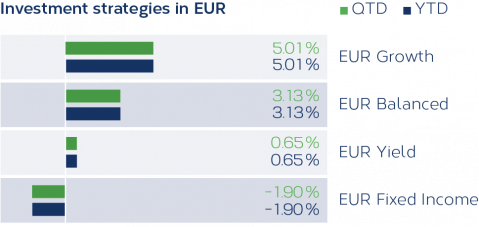

As in 2020, equities were the main performance driver in the first quarter of 2021. Consequently, riskier investment strategies outperformed thanks to the higher equity allocation. In equities, the Asia and Emerging Markets regions lagged behind North America and Europe. The interest incomefocused investment strategies achieved a negative performance in the first quarter due to the rise in bond yields. Inflation-linked bonds were able to offer some protection in this environment. High yield bonds benefited from the further decline in risk premiums.

Calculation LMM; reference date 31.03.2021

Note: the figures are before costs (exclusive of custody- and management fees)

Calculation LMM; Period 01.01. – 31.03.2021

LMM COMPASS

With our newsletter we provide information about the current situation on the financial markets, current investment topics and LMM.