LMM BLOG

INDEX PRODUCTS - WHAT TO LOOK OUT FOR

Indices enable investors to quickly find out about the mood on the stock market. In practice, they are also used to assess investment results in asset management (benchmarking). Financial products based on the development of indices (e. g. ETFs or structured products) are also increasingly represented in portfolios. Accordingly, it is important to consider the calculation method and composition of indices in order to be able to assess developments accurately.

Basically, two different types of indices, that can be calculated, differentiate:

• Price indices: Only share prices are used for calculation.

• Performance indices (total return indices):

In addition to price changes, these also include dividend payments.

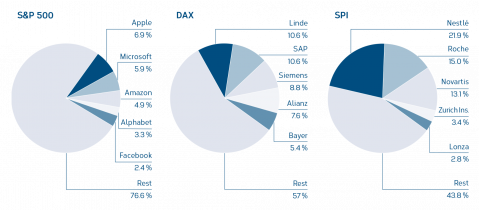

In addition to the method of calculation, the index composition is essential. Most major indices (e. g. DAX, S&P 500, etc.) are capital weighted. These take into account the absolute size (market capitalisation) of the stock corporation. The share prices are multiplied by the number of shares, whereby only that part of the shares which is in free float is taken into account. Taking the US stock market (S&P 500) as an example, the 10 largest companies currently (as of 31. 08. 2020) account for around 29 % of the S&P 500. In addition, the top five positions are occupied by the technology giants Apple, Microsoft, Amazon, Facebook and Alphabet (23.6 % in total). Before the Corona crisis, the share of these companies was just around 20 %.

Investors are often unaware of the impact on diversification in a portfolio of ETFs based on a capitalweighted index. In the case of the S&P 500, the average weighting of a share is 0.2%. Currently, Apple with almost seven percent and Microsoft with around six percent are the two most heavily weighted shares. This can be seen even more impressively on the Swiss share index SPI. The three largest stocks account for around 50 % of the index (Nestlé 22 %, Roche 15 % and Novartis 13 %). In the belief that a diversified index product has been bought, this can create cluster risks that investors are not aware of at first glance.

In addition, ETFs based on capital-weighted indices do not offer the possibility of giving a share a lower weighting after an above-average price increase. The weighting of investment styles such as growth or value is determined by the index provider.

The proportion of shares that show good momentum increases automatically. So-called equal weight strategies, which gives all shares included in the index the same weight, avoids these “bias” effects. When comparing the performance of stock indices, the weightings of the individual sectors must therefore also be analysed. A comparison of the US stock market with its German counterpart shows significant differences in the weighting of the individual sectors.

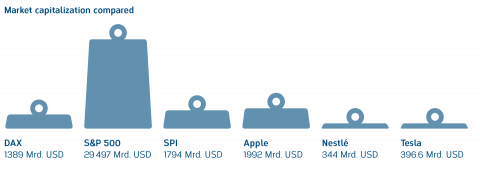

In the current environment we would like to point out another aspect: A comparison of the capitalisation of all companies in an index highlights the differences in size between the US and Europe. The DAX 30 companies currently have a total valuation (market capitalisation) of USD 1389 billion. Apple alone has a market capitalisation of USD 1992 billion, which is around 1.4 times the value of all DAX companies. The five tech giants have a total valuation of around USD 6900 billion. In the global share index MSCI World (MSCI ACWI) with a total of 2984 companies, these companies now represent a share of 13.2 %.

Conclusion

These explanations make it clear that investors should be aware of the composition of the underlying index when selecting and weighting index products. This statement applies to all indices and index products. Otherwise, investment results in terms of risk and performance may be different from what the investor expects.

LMM COMPASS

With our newsletter we provide information about the current situation on the financial markets, current investment topics and LMM.