LMM BLOG

GOLD AS AN ASSET CLASS

Gold as an asset class is still seen by many investors as one of the best hedges against inflation and economic uncertainties. Even in the crisis-ridden times of recent years, gold has often lived up to its reputation as a “safe haven currency”. We have collected some facts below to help you better categorise an investment in gold.

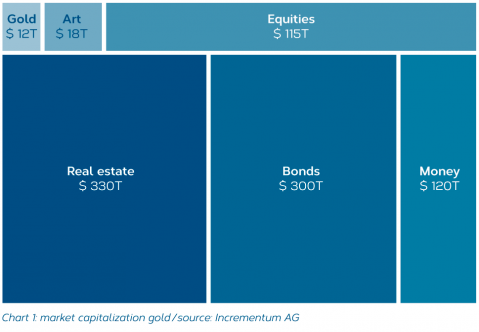

Market capitalisation and liquidity

Gold has a significantly lower market capitalisation than bonds or shares. The liquidity of gold depends on the form in which you invest. The limited liquidity and higher transaction costs of physical gold are offset by the high liquidity and low transaction costs of structured instruments - especially ETFs.

Main players on the gold market

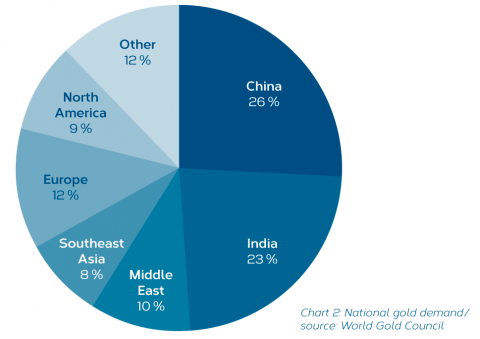

The main players in the gold market vary, but the jewellery industry and central banks are among the most important. Historically, the jewellery sector has dominated, with a marked increase in purchases by central banks since 2022. Asian central banks again accounted for the bulk of gold purchases. For the first time in many years, China was also an official buyer. It is worth noting that three major energy exporters - Qatar, Iraq and the United Arab Emirates - are now among the top ten gold buyers. Recently, private individuals have also increasingly invested in physical gold in order to achieve additional diversification in their portfolios.

In terms of geographical demand, India and China are the key markets. Together they account for around 50 % of global demand for gold. Demand for jewellery in India is particularly high.

Annual gold production

Annual gold production worldwide is in the thousands of tonnes. Production can vary depending on economic demand and gold market conditions.

The list of the world's largest gold producers may change over time as gold production is influenced by a number of factors, including the development of new mines, political stability and world market prices. The world's largest gold producers are China, Russia, Australia, USA, Canada, South Africa, Peru and Ghana.

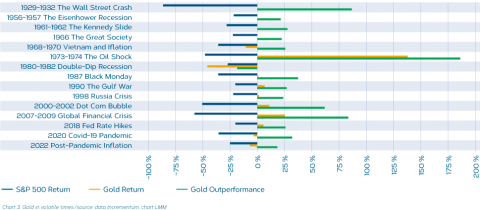

Historical performance

Gold has historically performed well in times of economic uncertainty. As such, it often serves as a safe haven for investors. It is worth noting that an ounce of gold has maintained its purchasing power for over two thousand years.

Advantages and disadvantages of gold as an asset class

Pro

- A long history as a store of value and a hedge in times of crisis.

- Material scarcity provides a hedge against inflation.

- Possibility of physical ownership.

- Not dependent on third parties.

- Globally recognised and tradeable.

Contra

- Difficulties with authentication.

- In the case of non-physical ownership, you are dependent on a third party.

- No income in the form of interest or dividends.

- Difficult to divide and therefore limited use as a currency.

- Higher costs to buy and sell physical gold.

LMM COMPASS

With our newsletter we provide information about the current situation on the financial markets, current investment topics and LMM.