LMM BLOG

DEFLATION OR INFLATION – EFFECTS ON YOUR FINANCIAL ASSETS

The infection of the economy with the conoravirusv resulted in historic price movements on the capital markets. Just as rapidly as prices fell at the end of March, they rose again in the following months. However, the picture is not uniform and the results vary considerably by country and above all by sector. The IT and consumer goods sectors have lost the least and are even in positive territory YTD. At the negative end are the energy and financial sectors, which suffered the biggest losses in March and are still clearly in the red since the beginning of the year. When it comes to the outlook, most investment houses are still cautious at present, as the number of uncertainty factors and their interdependence is considered very high.

Central banks and governments have taken extensive measures to combat the crisis. The financial scale of the various rescue packages is unprecedented in history, and previously applicable rules on limits on government debt are suspended until further notice. Due to the uncertainty, many investors

are asking themselves whether the greater risk is deflation or inflation?

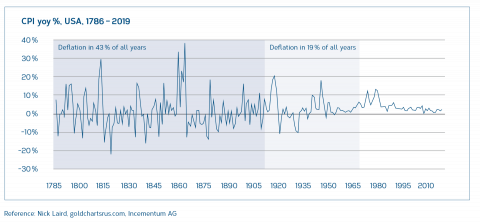

The following chart shows the Consumer Price Index (CPI) in the U. S. year-on-year over a long time series between 1786 and 2019, clearly showing that since the establishment of the Federal Reserve in 1913 and even more so with the end of the Bretton Woods Agreement in 1973, the phases of deflation have declined significantly. Central banks are forced to do everything possible to prevent sustained deflation (“whatever it takes”), as the consequences for highly indebted countries would be dramatic.

In the short term, analysts agree that the deflationary effects of the crisis will predominate. Demand shocks have an inherently deflationary effect. A look at the slump in oil and commodity prices seems to confirm this assumption. The decline in consumer demand as well as the overall lower

commodity prices are having a dampening effect on consumer prices. In addition, the rise in the unemployment rate, which has risen sharply in some cases, will result in little pressure from wage developments.

The long-term effects are assessed inconsistently. Moderate growth in the global economy is predominantly expected in the coming years. This fundamentally argues against inflationary pressure. However, the tendencies to restrict open world trade - keyword customs duties - and the relocation of production back to the home countries could lead to inflation for some products. Globalisation has been cited in recent years as one of the drivers of low inflation rates.

Added to this is the massive creation of money by the various measures taken by the central banks. Normally, this development would immediately send out an alarm signal for rising inflation rates. 9/11 has taught us that an expansion of the money supply by the central banks does not necessarily lead to rising inflation. In many cases the money “landed” in bank reserves and did not reach the real economy or the consumer. The velocity of circulation of money has declined sharply and has counteracted the inflationary effect by expanding the money supply.

In recent years, and probably in the medium term as well, the central banks see weak economic activity and persistent deflation as a major threat. The signs are therefore still pointing to “quantitative easing”.

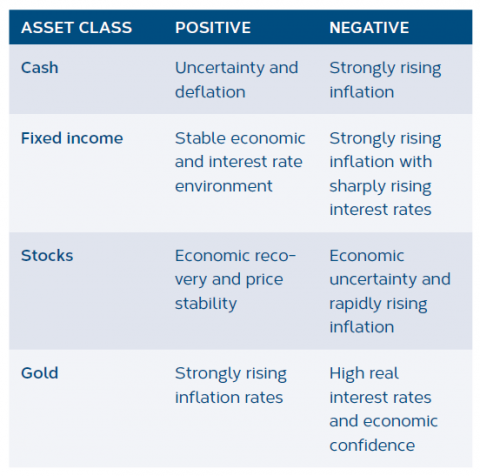

It is therefore unclear whether and when inflation will become an issue. Nevertheless, investors should be prepared for different scenarios. One of the simplest and most efficient ways to minimize risk is diversification. The following simplified illustration shows how asset classes can react in different scenarios: In addition, the measures taken by central banks and politicians have a strong influence on the capital markets. In conclusion, we return to the generally valid conclusion that a distribution across all asset classes leads to an optimisation of the overall risk and takes into account the uncertainty of forecasts.

LMM COMPASS

With our newsletter we provide information about the current situation on the financial markets, current investment topics and LMM.