LMM BLOG

BONDS AS A RISK BUFFER?

For a long time, bonds were considered a stabilising factor in a portfolio. In many cases, they were able to dampen the fluctuations or price declines of shares and protect them during market corrections. Last year, many investors realised that this assumption is only valid to a limited extent. Many portfolios also recorded considerable losses in bonds in March.

What is the reason for this and what should be considered in the future?

The continuing low-interest phase has led to more and more government bonds showing negative yields even with long maturities of up to ten years. Investors have therefore increasingly turned to corporate bonds. But here, too, investors were forced to make more and more concessions on the creditworthiness of the issuer in order to achieve attractive or positive yields. Financially sound issuers such as Nestlé with ratings in the A range are currently showing negative yields even with longer maturities. In search of yield, more and more managers have therefore moved into the lower rating segments.

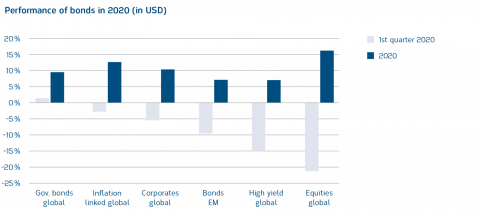

March 2020 has shown that corporate bonds close to “non-investment grade” are increasingly “equity-like” risks. In market corrections, they do not have a stabilising effect, but can even increase volatility. The following chart shows the development of various bond segments in 2020. The chart illustrates that only quality bonds with long durations offered protection in March 2020. US bonds have also benefited from the decline in interest rates. Corporate bonds, especially those with lower credit ratings, have suffered significant losses in the meantime. It is therefore advisable to keep an eye on the risks when so-called “yield picking” takes place. One thing is always true: the higher the yields, the higher the default risk.

What alternatives do investors have in this environment?

Interest rate differentials have narrowed further. The advantage of this is that currency hedging has become cheaper. Investors thus have access to more bond segments, which increases the possibilities for diversification. However, the fundamental problem of low or negative interest rates remains.

How are the professionals in asset management acting?

It can be observed that banks and asset managers are increasingly recommending other asset classes instead of bonds. Gold, Hedge Funds, insurance-linked securities (ILS) and Private Debt are mentioned as attractive alternatives (complementary asset classes). Investors should be aware that each asset class has a different risk/return profile and should be assessed in the portfolio context. Transparency and costs are other factors that should always be kept in mind.

The bond market has become increasingly unattractive for investors. In many segments, one is not compensated for the risks taken with an adequate return. Caution is advised when shifting into alternative asset classes, especially with investment solutions that offer little transparency. Moreover, in addition to the risks, the costs should also be examined.

LMM COMPASS

With our newsletter we provide information about the current situation on the financial markets, current investment topics and LMM.