LMM BLOG

INVESTMENT ORGANISATION OF FAMILY OFFICES

The management of large investment portfolios poses new challenges to those responsible, first of all the owners of the assets, the investment managers and the respective technical experts from the areas of banking, asset management, reporting and monitoring, as well as tax, real estate and law on an almost daily basis. When reorganizing or reviewing existing structures, it often becomes apparent that many interests and already existing relationships must be taken into consideration or included in the analysis. Regardless of this, an open, independent and transparent analysis is recommended, which should include the following points:

Personal

- The investment organization or its success is based not only on a professional set-up with clearly structured processes and assigned responsibilities, but also on trust. Often there are already long- standing and successful relationships with the family office and the investment committee as well as with business partners from the already mentioned areas of banking, asset management, tax or real estate, which must be taken into account with appropriate care during the analysis.

- As a starting point, one should determine which tasks are to be organized in principle, irrespective of whether certain areas of responsibility are already regulated.

- Core tasks are: Asset management, reporting and controlling, accounting, tax, real estate management, succession planning and family governance.

- When defining the tasks, it is advisable to focus on the W-questions: who, what, when, how, etc.

Costs

- The question of costs is very important and a projection of the expected costs alongside a business plan is recommended.

- The sharing of costs can be simplified into set-up and investment costs as well as running costs.

- Besides personnel, the costs for infrastructure (offices, EDP), software and licenses as well as consulting fees have to be considered.

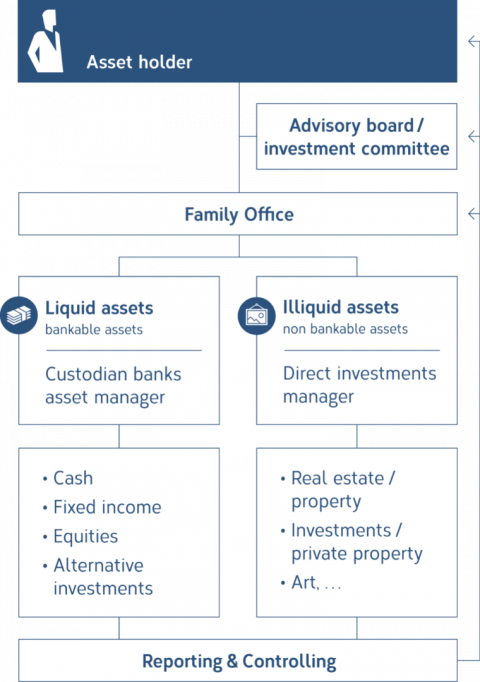

Separation of functions

- To protect the interests of the client, a clear distinction should be made between the functions of “setting the strategy”, “implementation” and “monitoring”.

- The advisory board/investment committee usually sets the strategy, and the implementation is delegated to specialists (portfolio managers). The monitoring of the investment activities is carried out by an independent control unit.

Monitoring and reporting

- The management and development of the assets must be monitored on an ongoing basis so that any undesirable developments can be identified at an early stage (early warning system).

- The reporting and controlling unit is to be organized in such a way that transparent and customized reports with meaningful information are madeavailable to the decision-makers in a timely manner.

Infrastructure / Software

- A lot depends on the quality of data management. Efficient and goal-oriented asset management can only be achieved on the basis of meaningful and professionally prepared data.

- The question with regard to an internal or external solution approach depends on the size and complex-ity of the assets. Costs play an overriding role.

- The main cost centers are personnel, infrastructure, software (acquisition and maintenance) and data (price and business information systems).

Employees

- In order to be able to guarantee high-quality data management, it is imperative that the necessary resources (personnel and professional) are available.

- With regard to personnel, care must be taken to ensure that deputies have been selected and that there is no dependency on individual persons.

What points are important when implementing a professional investment organization?

- Separation of powers in the interest of the customer

- Clear allocation of tasks and structured processes

- Timely, transparent and meaningful information

- Structures / responsibilities have to be consistent with the requirements and the complexity of the assets

- Selective delegation (outsourcing) leads to optimized costs, lower risks and know-how transfer

- 4-eyes principle reduces possible conflicts of interest

LMM COMPASS

With our newsletter we provide information about the current situation on the financial markets, current investment topics and LMM.