LMM BLOG

VENTURE CAPITAL – WHAT NEEDS TO BE CONSIDERED

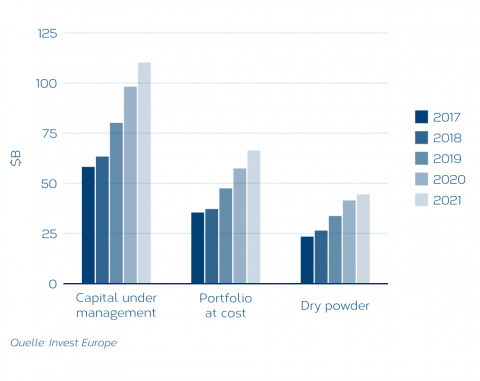

The share of "private market investments" in the portfolios has steadily increased in recent years. In addition to private equity funds that invest in established companies ("later stage"), funds that invest in early- stage companies ("venture capital") have also had high inflows.

Capital under Management

We spoke with Daniel Keiper-Knorr, Founding Partner of the VC investment manager Speedinvest, about the opportunities, risks and special features of venture capital:

Mr Keiper-Knorr, what basic principles should be kept in mind when investing in the VC asset class?

Basically, the same principles apply to VC investments as to other asset classes. Due to the inherent illiquidity, special attention should be paid to sufficient diversification and a long-term investment horizon.

What points should the investor consider when choosing a VC manager?

Due to the long-term nature of the investment horizon, the team, the track record and the consistency of the investment strategy are of particular importance. Therefore, one should definitely ask for references before deciding on a manager. Serious VC managers are usually willing to open up contacts for reference calls.

What is the expected return on a VC fund?

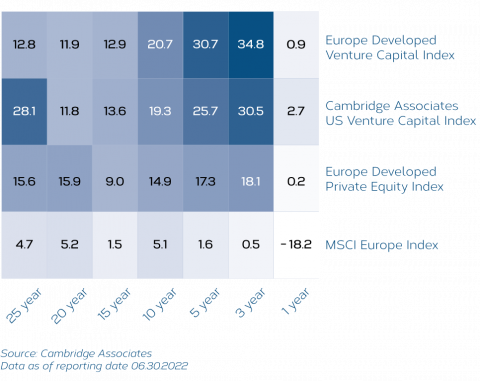

VC has a higher risk than liquid asset classes. Therefore, VC must also achieve higher returns. And in along-term comparison - and o nly this is admissible - VC also achieves these excess returns. There are numerous studies on this. For example, the Cambridge Associates US VC index has clearly outperformed the S&P500 in the past 25 years, with an annual return of 28.1 % compared to 8.0 %.

Comparison of returns

What are the three most important key figures for assessing the performance of a VC fund?

The performance of VC funds is usually measured in three key figures.

• TVPI: "total value to paid in" the performance of the portfolio in relation to the paid-in capital

• DPI: "distributions to paid in" actual distributions in relation to paid-in capital

• NetIRR: the annualised net return in % after all costs

What kind of capital commitment should a VC investor expect?

In any case, a capital commitment of several years is to be expected. It should be noted that the committed capital is injected over several years in so-called capital calls.

What impact does the rise in interest rates have on the VC sector?

The recent rise in interest rates is also a challenge for the VC industry. However, the normalised valuations also offer attractive entry opportunities again.

What is the failure rate for VC investments?

And what is the success rate?

This depends primarily on the phase in which you invest. The earlier, the higher the failure rate. Early-stage VC expects a 50 % or higher failure rate. Therefore, the more successful the investments, the higher the failure rate must be for a VC fund to achieve the rewquired return. Often the success of a VC fund depends on one or a few individual investments, each of which

can earn back the fund several times over.

Which themes should an investor focus on in the coming years or is a portfolio diversified by themes preferable?

VC is a long-term asset class and, as such, VC naturally focuses on future themes that are expected to be reflected in performance only in the coming years. These are themes such as digitalization, decarbonization, demographics and others. Similar to liquid markets, there are funds that specialize in single themes and funds that focus on multiple themes. Because of the high barriers to entry into VC funds, which are set by law among other things, the decision whether to invest in a multiple specialty fund or a broader fund also depends on the overall size of the portfolio.

How can sufficient diversification across different companies be ensured in practice?

Funds are an easy way to achieve diversification. Unless you are a professional investor yourself and can devote sufficient time and resources to the subject. At Speedinvest, 40 investment managers are exclusively responsible for origination and portfolio management. Speedinvest analyzes about ten thousand investment opportunities per year and selects only about 30-40 per year.

How attractive is the start-up scene in the DACH region?

The start-up scene in DACH has developed very well in recent years. Berlin is the third most important city in Europe after London and Paris. But other regions such as Stockholm, Madrid, Amsterdam, Munich and Eastern Europe are also developing very dynamically. For example, UIpath, the largest European tech IPO in recent years, came from Bucharest.

Do European VC managers have disadvantages compared to the competitors in the US and UK?

VC has a greater tradition in the US and UK than in DACH and other parts of Europe. However, European VC managers have outperformed the competition from the US in recent years.

See: https://fortune.com/2021/12/07/european-venture-capital-outperforms-atomico-100-billion/

On what basis are the valuations of VC investments made?

VC investments are long-term investments with an investment horizon of 5, 10 or even more years. Therefore, the valuation is primarily based on the long-term future prospects of the companies. Since VC also invests in the very early phase of the companies, in which usually no profits and sometimes not even sales are generated yet, conventional valuation methods (e.g. DCF) are only suitable to a limited extent.

Is there empirical data to support the average development of investments in a VC-portfolio?

About 1-2% of a vintage achieve a "unicorn" valuation. This rate is fairly constant over the years. Data on this is available from the likes of atomico or cbinsights:

https://stateofeuropeantech.com/3.companies

https://www.cbinsights.com/research/regional-vc-funnels/

Conclusion

In summary, for most investors an investment in venture capital can only be considered in the form of a fund. This is the only way to ensure sufficient diversification and professional management.

A diversification according to managers and years of entry ("vintage") is advisable, but requires a corresponding minimum capital. Overall, the share of illiquid investments in the total assets must be tailored to the needs and goals of the investor.

LMM COMPASS

With our newsletter we provide information about the current situation on the financial markets, current investment topics and LMM.