LMM BLOG

MARKETS AND STRATEGIES 2018 Q4

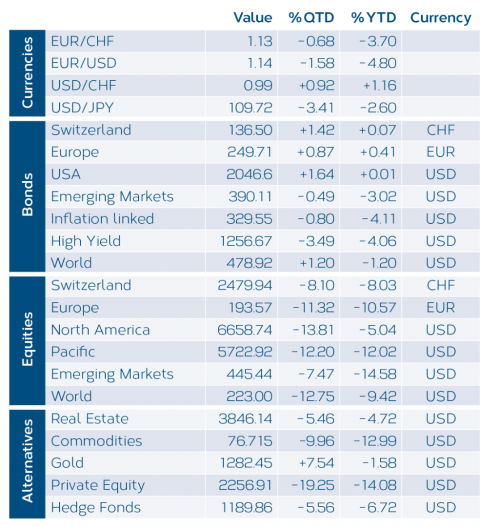

The relatively stable US stock market including the technology stocks also suffered considerable losses of more than 13%. The whole market sentiment was characterized by significant price declines in most asset classes, and only government bonds benefited from price gains due to their “safe haven” status (eg. government bonds US, Germany, Switzerland). As expected, the US central bank raised interest rates again in December. Further rate moves will depend on the economic development. Financial specialists expect further economic growth in 2019, albeit at a slower pace, due to slower earnings growth, political uncertainties and a more restrictive monetary policy.

Reference date: 31.12.2018

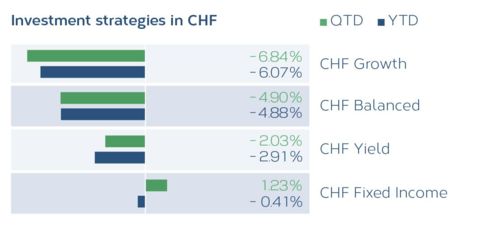

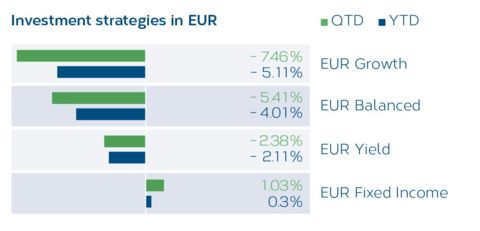

In the fourth quarter, the level of equity weighting was crucial for the performance, meaning that, depending on the equity allocation, more or less all investment strategies have lost in value on average. This means, the greater the equity component in the portfolio, the greater the negative performance impact. Over the year, most investment strategies are increasingly considering a negative performance (note: excluding costs).

LMM COMPASS

With our newsletter we provide information about the current situation on the financial markets, current investment topics and LMM.