LMM BLOG

MARKETS AND STRATEGIES 2018 Q2

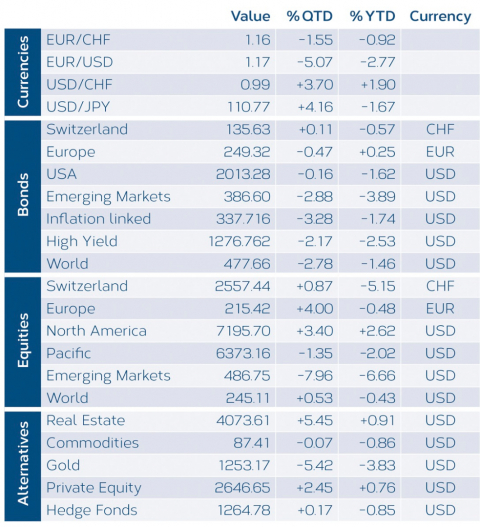

Exceptions were emerging market stocks which suffered from significant price setbacks. Bonds and currencies from these countries also suffered from price declines. The reasons are believed to be higher U.S. interest rates and the stronger US Dollar. Interest rates in Europe remain low, whereby Italian bonds had to put up with substantially higher interest rate premiums due to the political uncertainty.

Reference date: 30.06.2018

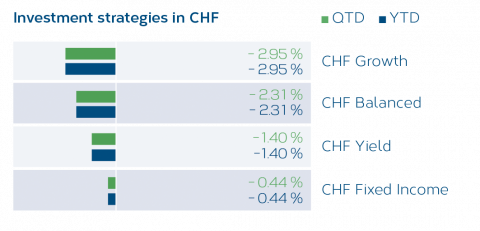

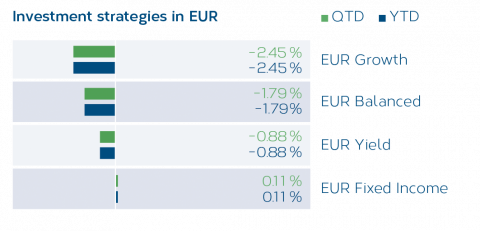

After the negative performance in the 1st quarter 2018, investors benefited from the recovery on the stock markets in the 2nd quarter. Those that particularly stand out and were able to post gains were investment strategies with a higher allocation in stocks, such as “Balanced” and “Growth”. Investors in the Eurozone were able to benefit as well from currency gains on US Dollar positions. Because the US Dollar revaluated due to higher interest rates and a stable economic growth

LMM COMPASS

With our newsletter we provide information about the current situation on the financial markets, current investment topics and LMM.