LMM BLOG

Markets and strategies 2025 Q4

In 2025, global markets experienced overall positive development despite ongoing geopolitical tensions and economic uncertainties. The global economy showed moderate growth, supported by steady consumer demand and positive corporate earnings in developed countries. Central banks, particularly in the US and Europe, opted for interest rate cuts to stimulate economic growth. This policy contributed to market stabilization and supported investor risk appetite.

In emerging markets, growth was uneven, with some regions benefiting from a strong recovery, while others were impacted by geopolitical uncertainties and local crises. Trade relations between the US and China remained tense, leading to repeated trade barriers and disruptions in global supply chains. On the bond markets, government bonds from developed markets dominated. In equity markets, positive performance was observed, with particularly strong gains in technology stocks and emerging markets. Gold benefited from the interest rate policy and experienced growth as a safe haven. Silver also showed positive development toward the end of the year, benefiting from both the interest rate cuts and rising industrial demand, making it a valuable alternative in portfolios.

Strategies

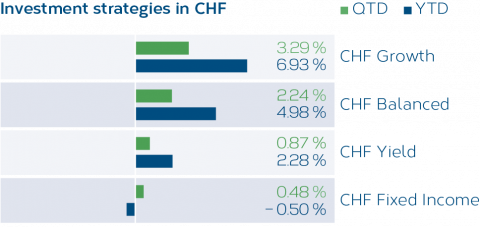

In the fourth quarter of 2025, all CHF and EUR investment strategies showed positive results, except for EUR interest income. Over the course of 2025, results for CHF investment strategies ranged from –0.50 % to +6.93 %, while EUR strategies ranged from +0.35 % to +7.83 %.

Calculation LMM; reference date 01.01.–31.12.2025

Note: the figures are before costs

Calculation LMM; Period 01.01.–31.12.2025

LMM COMPASS

With our newsletter we provide information about the current situation on the financial markets, current investment topics and LMM.