LMM BLOG

MARKETS AND STRATEGIES 2024 Q4

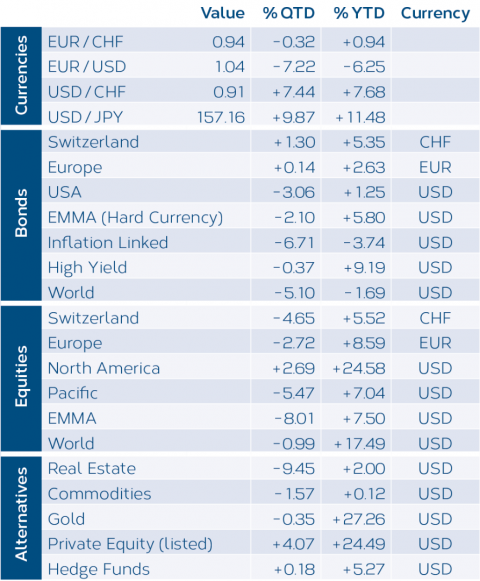

2024 was a strong year for equities, led by the US with a total performance of 24.60 % and 7.50 % for emerging market equities. A late rally in China, solid results in India and Taiwan, and a strong performance in US technology stocks were noteworthy. Financials benefited from deregulation prospects following the US elections, while commodities were weighed down by weak demand from China. Gold stood out with a performance of 27.25 %.

The US economy remained robust, with an average GDP growth of 2.60 %. In Europe, growth weakened due to high energy costs and regulatory challenges. In Asia, China suffered from weak consumer confidence, while Japan, with a performance of nearly 20 %, benefited from optimism that deflation is coming to an end.

In the bond markets, high-yield bonds delivered the best performance, exceeding 8 %. Investment-grade bonds struggled with rising yields. European bonds outperformed US bonds due to expectations of interest rate cuts. Global disinflation slowed in the second half of the year, leading to a reassessment of rate cut expectations.

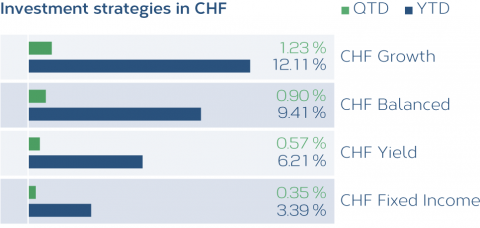

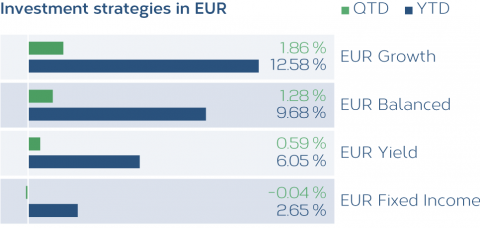

In the fourth quarter of 2024, all CHF and EUR investment strategies showed positive results, except for EUR fixed income. Long-duration bonds underperformed due to rising government bond yields. Over the entire year 2024, CHF investment strategies yielded results ranging from +3.39 % to +12.11 %, while EUR strategies delivered between +2.65 % and +12.58 %.

Calculation LMM; Period 01.01.2024–12.31.2024

Note: the figures are before costs

Calculation LMM; Period 01. 01.2024– 12.31.2024

LMM COMPASS

With our newsletter we provide information about the current situation on the financial markets, current investment topics and LMM.