LMM BLOG

MARKETS AND STRATEGIES 2021 Q4

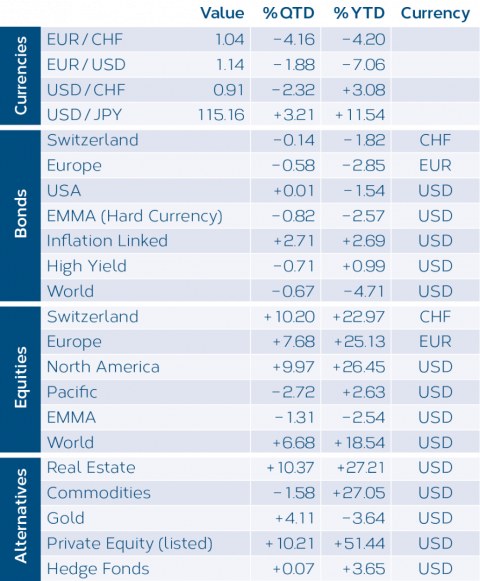

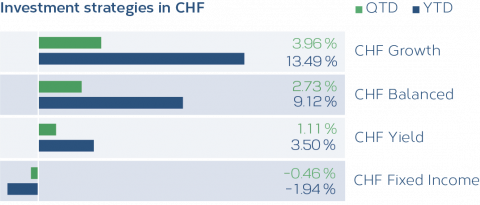

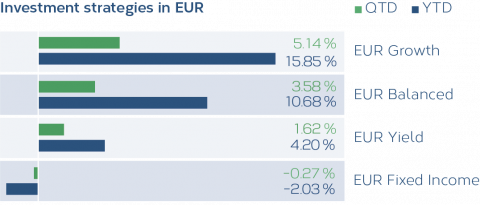

Bonds – with the exception of a few categories – closed the year (2021) in the red. Inflation-protected bonds are a positive surprise with a quarterly and annual return of just under 2.70 %. In contrast, global equities showed an above-average increase in value of 18.54 % in 2021. In particular, the shares of developed countries have once again increased in price significantly in the fourth quarter. The winners over the year are once again North American equities with a plus of 26.45 %. In contrast, equities from emerging countries posted a negative return of – 2.54 %. All investment strategies in CHF and EUR with an equity component outperformed last year. The higher the equity quota in the investment strategy, the higher the return. Only the investment strategies focusing on interest income in the reference currencies CHF and EUR showed a negative performance due to rising interest rates.

Calculation LMM; Period 01. 01.– 31. 12. 2021

Note: the figures are before costs

(exclusive of custody- and management fees)

Calculation LMM; Period 01. 01.– 31. 12. 2021

LMM COMPASS

With our newsletter we provide information about the current situation on the financial markets, current investment topics and LMM.