LMM BLOG

INVESTMENT REPORTING FOR FAMILY OFFICES

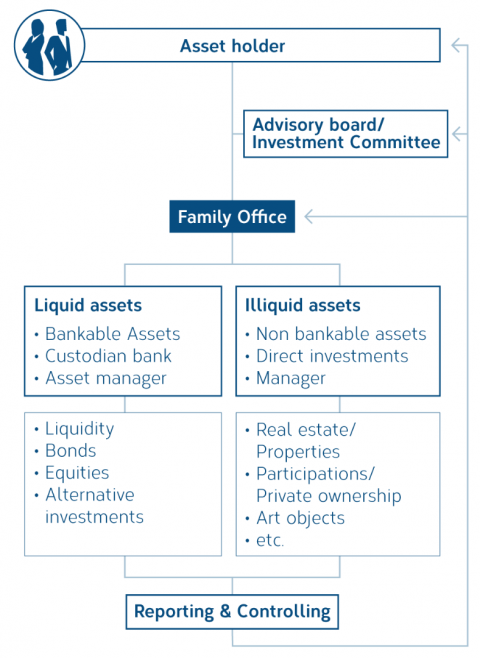

Family office

The family office plays a pivotal role as coordinator of various areas such as tax planning, asset structuring, charity, family governance and asset management. Once the various areas have been organized and their relation with asset management have been defined and regulated, the family office is responsible within asset management for ensuring that the investment organization and its processes, from the overarching investment strategy to the implementation of the investment strategy, fully reflect the needs of the asset holder and pursue these needs alone.

Investment controlling and reporting

Timely and seamless monitoring of implementation creates the best possible transparency in terms of risk, return and costs and identifies any need for action at an early stage and in a comprehensible manner. Regular reporting to the asset holder and the relevant bodies, in line with the level and requirements, creates the basis for efficient and targeted management of the total assets.

Investment reporting

Investment reporting is intended to provide the responsible parties with the necessary information for the efficient management of assets. This must be done promptly and in a meaningful format. In practice, the presentation of asset performance in asset manager reports is often inconsistent. This makes it difficult to get a quick overview to evaluate the results. The consolidation of all assets and standardized preparation of data by the reporting office enables a transparent comparison and reliable analyses of the development of assets.

In addition to financial assets, the total assets of an asset holder often consist of further asset classes such as direct investments, real estate or art objects. These must also be included in the reporting in order to enable efficient overall asset management. Reports to decision-makers should contain the key information relevant to management. The structure, content and frequency of the reports depend on the complexity and size of the assets as well as the needs of the report recipients.

Graph: Source LMM Investment Controlling Ltd.

Content of the investment reporting

The reports should provide answers to the following questions, among others:

- How did the assets develop overall, at portfolio level and at the level of the individual asset classes during the reporting period?

- How should the investment results be assessed?

- How did the risk of the investments and the portfolio as a whole develop?

- Were the fees charged in accordance with the agreements?

- How have the indirect costs developed?

- Were the transactions executed in line with the market?

- Were the contractual requirements met?

The above points should be monitored on an ongoing basis rather than on a reporting date basis. The investment report summarizes the results of this monitoring for the reporting period.

The investment report usually consists of the following elements:

- Investment results: consolidated, at the level of asset classes and mandated service providers

- Performance analysis: attribution and contribution analysis, benchmark and peer group comparisons

- Risk analysis: market risk, credit risk, liquidity risk

- Compliance and cost analysis: compliance with requirements, analysis of direct and indirect costs, market conformity of transactions.

Conclusion

- Targeted investment reporting for family offices should be meaningful, personalized and transparent.

- It includes performance analyses, risk management, long-term planning, tax aspects as well as sustainability reports.

- The aim is to fulfill the needs of the report recipients and support them in achieving their financial goals.

LMM COMPASS

With our newsletter we provide information about the current situation on the financial markets, current investment topics and LMM.