LMM BLOG

ARE HEDGE FUNDS A SUITABLE BOND SUBSTITUTE?

After hedge funds could not prove their “all-weather suitability” during the 2008 financial crisis they came under pressure and investors were losing their interest. However, recently we observe a renaissance. The record-low interest rates are forcing investors to consider alternatives to bonds. The question arises whether hedge funds are suitable for the job.

Reference index data does not show reality

Performance data from hedge funds has to be analysed with caution, since they are not required to publish their data. Reference indexes are mostly fed by successful hedge funds. Closed funds fall out of the data series. The resulting index data shows significantly overvalued returns versus the effective returns of the whole hedge funds universe. This effect is called survivorship-bias.

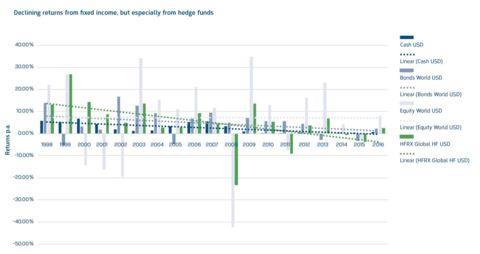

Historical estimates suggest that hedge funds have been able to achieve returns that are well above an average of bond and stock market in the past. So despite the “bias-effects”, they were quite attractive. However, recent studies show that hedge funds’ returns were consistently lower between 2009 and 2016.

Our own analysis confirm these observations. Returns on a portfolio consisting of 45% equities, 45% bonds and 10% cash have fallen from 7.36% (in USD) between 1998 and 2007 to 4.25% p.a. between 2007 and 2016 – mainly due to the deflationary environment and the low interest rate policy. By contrast, the average annual returns of hedge funds went back from an above average 9.96% to a below average -0.08% p.a. in the two comparative periods.

The lower performance of Hedge funds can only partially be explained by lower market returns, e.g. by the lack of interest on collaterals, in recent years. The steady upswing in the financial market, stimulated by the national banks, has resulted in reduced market volatility and increased correlation between and within almost all investment categories. This environment was detrimental to most Hedge funds strategies.

Diversification and optimization potential

According to our model calculations the return expectation will rise, if we gradually replace bonds by hedge funds in a model portfolio with 10% liquidity, 45% bonds and 45% shares.

However, the higher return is achieved at the expense of higher fluctuation risks. This increase in risk can be explained by the higher correlation of hedge funds with equities. This high correlation applies to the entire universe, not necessarily on individual hedge funds strategies.

Consequently, hedge funds as an investment category are not a suitable substitute for bonds from a pure risk perspective. An alternative option would be to introduce hedge funds at the expense of both bonds as well as equity. With an improved diversification, it is possible to optimize the return-risk relationship of the portfolio. Despite these findings, when using hedge funds caution is advised. Not only a large number of providers and strategies but also their opacity and low regulations have to be considered in investment decisions. Knowledge about the hedge fund manager and his investment strategy are a premise. Not at least, the relatively high costs have to be questioned.

LMM COMPASS

With our newsletter we provide information about the current situation on the financial markets, current investment topics and LMM.